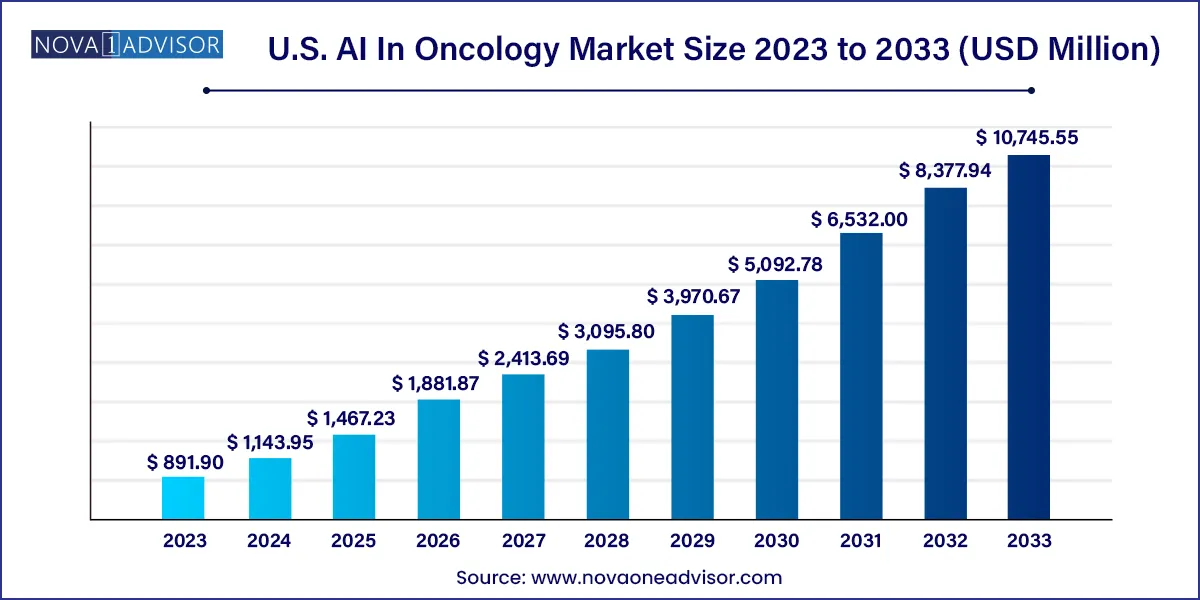

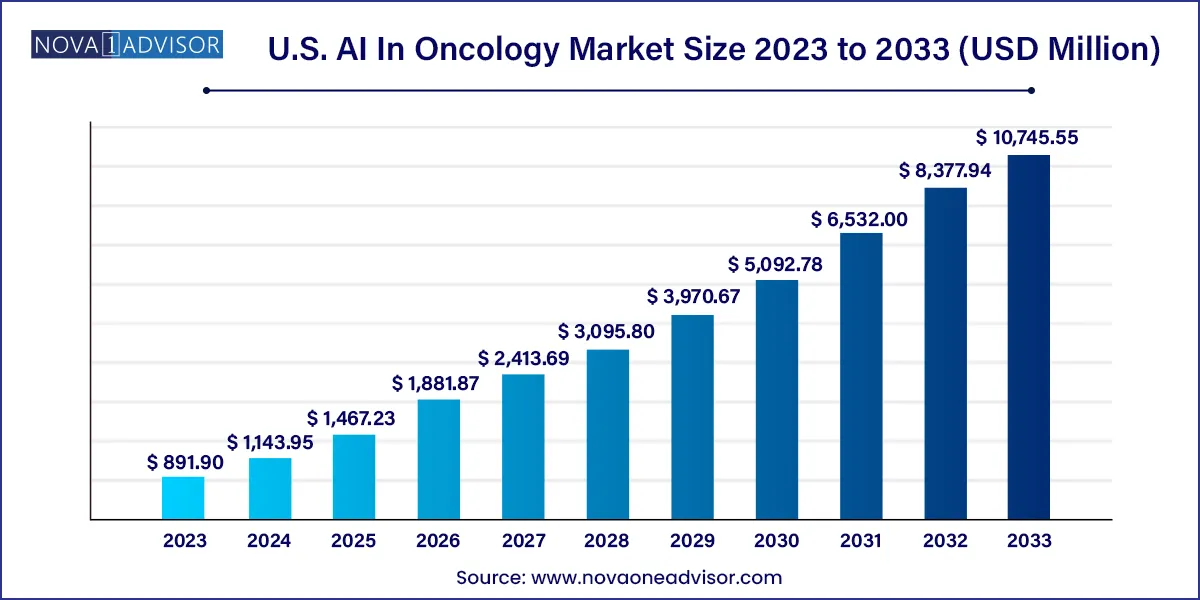

The U.S. AI in oncology market size was estimated at USD 891.90 million in 2023 and is projected to hit around USD 10,745.55 million by 2033, growing at a CAGR of 28.26% during the forecast period from 2024 to 2033.

Key Takeaways:

- Based on components, hardware dominated the market with a revenue share of 39.14% in 2023 and is anticipated to continue its dominance over the forecast period.

- The software solutions segment is anticipated to witness the fastest CAGR from 2024 to 2033.

- Based on cancer type, the others segment held the largest revenue share of 25.14% in 2023 and is anticipated to grow at a lucrative CAGR from 2024 to 2033.

- The prostate cancer segment is expected to register the fastest CAGR from 2024 to 2033.

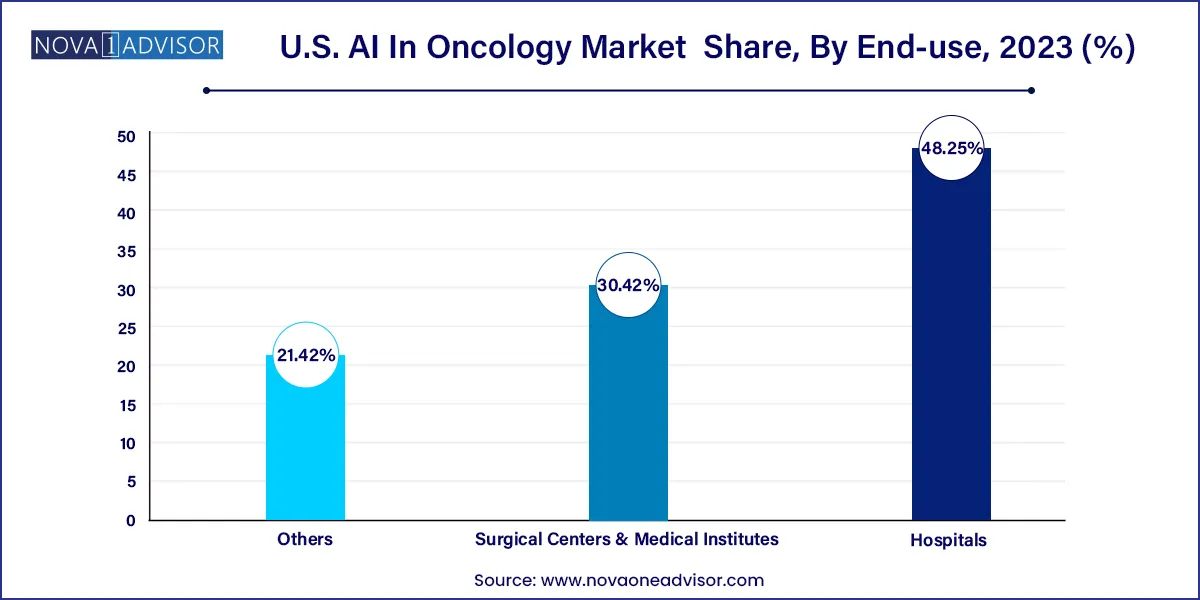

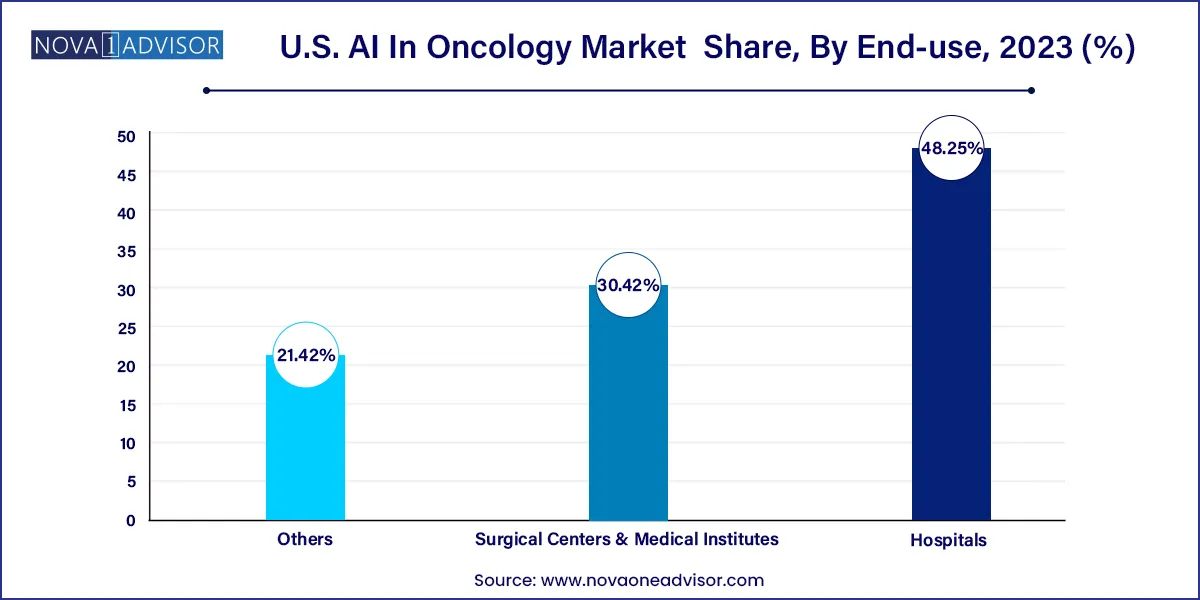

- The hospitals segment dominated the market with a revenue share of 48.25% in 2023.

- The market to cater to cancer care in hospitals, and positive responses from patients, are expected to boost the market during the forecast period.

U.S. AI In Oncology Market Overview

The U.S. AI in Oncology market is experiencing transformative growth, catalyzed by the integration of artificial intelligence (AI) into cancer diagnosis, treatment planning, drug development, and patient monitoring. As the incidence of cancer continues to rise across the United States with over 1.9 million new cancer cases projected in 2025 the healthcare sector is actively seeking more accurate, faster, and cost-effective solutions. Artificial intelligence, powered by machine learning (ML), natural language processing (NLP), and computer vision, is reshaping how oncologists detect, analyze, and treat cancer.

AI technologies in oncology are being embedded across the continuum of care from early screening tools that detect malignancies with superior sensitivity, to algorithms that personalize treatment regimens based on genomic and clinical data. The U.S., home to global health tech leaders and research institutions, has been a vanguard in this movement. Companies like Tempus, PathAI, and Paige are leveraging AI to decode complex pathology slides, stratify patients, and predict therapeutic responses.

Additionally, the integration of AI into radiology, pathology, and genomics is empowering multidisciplinary teams with actionable insights. With rising healthcare costs and a growing shortage of oncology specialists, AI is not just an innovation it is becoming a necessity to support clinical workflows and improve outcomes. Government initiatives such as the Cancer Moonshot and the increasing adoption of value-based care models are further boosting investments in AI-driven cancer technologies.

Major Trends in the Market

-

AI-Powered Imaging Diagnostics: Radiology tools using deep learning are improving early detection of breast, lung, and prostate cancers, often outperforming human radiologists in sensitivity.

-

Pathology Digitization and AI Interpretation: Companies are digitizing pathology slides and applying AI to identify tumor subtypes and grade malignancies with high precision.

-

Multimodal Data Integration: AI platforms now combine radiological, histological, and genomic data to provide a comprehensive picture of the tumor biology and inform treatment planning.

-

AI in Drug Discovery and Trial Design: Machine learning is accelerating oncology drug discovery by identifying biomarkers, predicting trial outcomes, and optimizing patient recruitment.

-

Clinical Decision Support Systems (CDSS): Hospitals are adopting AI-enabled CDSS tools that provide oncologists with treatment recommendations based on real-time patient data.

-

AI for Personalized Medicine: Algorithms are helping tailor chemotherapy and immunotherapy plans by analyzing tumor genomics and patient responses.

-

Collaborative Ecosystem Expansion: Partnerships between AI startups, cancer research centers, pharmaceutical companies, and cloud computing providers are rapidly increasing.

-

FDA Support and Regulatory Guidance: Regulatory bodies like the FDA are encouraging the development of AI-based diagnostic software through fast-track designations and digital health frameworks.

U.S. AI In Oncology Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 1,143.95 million |

| Market Size by 2033 |

USD 10,745.55 million |

| Growth Rate From 2024 to 2033 |

CAGR of 28.26% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Component, cancer type, application, end-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Azra AI; iCAD, Inc.; IBM; Siemens Healthcare GmbH; Intel Corporation; GE HealthCare; NVIDIA Corporation; Digital Diagnostics Inc.; ConcertAI; Median Technologies; PathAI |

Market Driver: Rising Demand for Precision Oncology and Early Detection

A primary driver of the U.S. AI in Oncology market is the rising demand for precision oncology and early cancer detection. Cancer remains the second leading cause of death in the United States, yet early diagnosis significantly improves survival rates. Traditional screening and treatment strategies often fall short in detecting tumors at an early stage or predicting patient-specific treatment responses. AI addresses this gap by leveraging massive datasets radiology images, pathology reports, genomic sequences, and electronic health records to generate predictive models that assist clinicians in making accurate and timely decisions.

For example, Google Health's AI model demonstrated breast cancer detection capabilities exceeding those of human radiologists in a study published in Nature. Similarly, Tempus’ xT platform integrates patient molecular data and uses AI to recommend targeted therapies. Such innovations are not only enhancing diagnostic accuracy but also reducing the time between diagnosis and intervention critical in fast-progressing cancers like pancreatic or lung cancer. The personalization of treatment using AI reduces unnecessary toxicity and increases patient outcomes, making it indispensable in the future of oncology care.

Market Restraint: Data Privacy, Bias, and Interoperability Challenges

Despite the optimism surrounding AI in oncology, there are significant barriers that may impede its full-scale adoption in the U.S. market. Chief among them are data privacy concerns, algorithmic bias, and the lack of interoperability among health data systems. AI models rely on large datasets that include personal health information (PHI), raising ethical and regulatory challenges, particularly under HIPAA guidelines. Ensuring secure data sharing without compromising patient confidentiality is a complex and ongoing issue.

Additionally, AI algorithms trained on biased or unrepresentative data may produce skewed results, especially in minority or underserved populations. For example, if a model is predominantly trained on data from white patients, it may misdiagnose or underperform for patients from other ethnic backgrounds. This not only impacts clinical outcomes but also raises concerns about healthcare inequality. The fragmented nature of U.S. healthcare data infrastructure, where EHR systems from different vendors do not easily communicate, further limits the seamless deployment of AI solutions across multiple institutions.

Market Opportunity: Integration of AI with Immunotherapy and Genomics

One of the most promising opportunities in the U.S. AI in Oncology market lies in the integration of AI with immunotherapy and genomic sequencing. As cancer care becomes increasingly tailored, the ability to predict immunotherapy responses based on tumor mutational burden (TMB), PD-L1 expression, or microsatellite instability (MSI) is becoming critical. AI models trained on vast genomic datasets can identify novel biomarkers, forecast immune response, and support patient stratification in clinical trials.

AI platforms like those developed by Paige and PathAI are now being used to assess immune cell infiltration in tumor microenvironments, providing valuable insights into potential responders to checkpoint inhibitors. Moreover, with whole-genome and exome sequencing becoming more accessible, AI tools can assist oncologists in interpreting complex genomic data and mapping it to therapeutic options. The synergy between AI, NGS (Next-Generation Sequencing), and immunotherapy is expected to redefine the therapeutic landscape in oncology, particularly for aggressive and treatment-resistant cancers.

U.S. AI In Oncology Market By Component Insights

Software Solutions dominated the U.S. AI in Oncology market, as the majority of AI-driven innovations are being delivered through software platforms that can be integrated with existing hospital information systems. These software tools include diagnostic imaging platforms, digital pathology readers, genomic analytics engines, and clinical decision support systems. For instance, Paige’s FDA-approved AI pathology software assists pathologists in detecting prostate cancer with higher accuracy. Similarly, Tempus’ software solutions use AI to match patients with ongoing clinical trials and identify potential therapy candidates.

Services are emerging as the fastest-growing segment, driven by the increasing demand for customized AI solutions, system integration, data annotation, and consulting. As hospitals and research centers seek to implement AI across their oncology workflows, they often rely on third-party vendors and AI specialists to tailor solutions, train staff, and maintain the systems. Moreover, companies are offering managed services that include remote diagnostics, predictive analytics, and reporting, helping institutions without in-house data science capabilities to adopt AI efficiently.

U.S. AI In Oncology Market By Cancer Type Insights

Breast Cancer led the market among cancer types, benefiting from the high prevalence rate and established screening programs across the U.S. AI has significantly enhanced mammography interpretation, enabling early and accurate detection of breast tumors. Google Health, iCAD, and other AI innovators have developed models that reduce false positives and minimize overdiagnosis. Additionally, digital pathology tools help pathologists determine HER2 and ER/PR statuses, critical for treatment planning.

Lung Cancer is the fastest-growing cancer type segment, owing to the increasing use of AI-powered CT imaging and predictive models to identify early-stage nodules. Lung cancer is often diagnosed at an advanced stage, and AI is helping shift this paradigm. The use of AI in low-dose CT screening, particularly among high-risk populations such as smokers, is being championed by public health agencies and hospitals. AI models are also used to evaluate tumor progression, assess radiomic signatures, and support the delivery of stereotactic radiation therapy.

U.S. AI In Oncology Market By End-use Insights

Hospitals accounted for the largest share, reflecting their central role in diagnosis, treatment, and data collection. AI solutions are being used across departments from radiology and pathology to oncology clinics to enhance care delivery. Integrated health systems like Mayo Clinic and Memorial Sloan Kettering are leading adopters of AI in oncology, with in-house research teams collaborating with startups to build tailored solutions. These institutions benefit from large patient volumes, making them ideal environments for training and testing AI models.

Surgical Centers and Medical Institutes are growing fastest, largely due to their agility in adopting advanced technologies and focus on specialized care. These centers often pilot cutting-edge AI tools in robotic surgery, radiation planning, and intraoperative imaging. For example, AI-assisted navigation systems are being used during brain tumor surgeries to delineate tumor margins with higher accuracy. Additionally, AI-enabled radiation contouring and planning solutions are being adopted to reduce planning time and optimize dosing in surgical oncology practices.

Country-Level Analysis

The United States leads the global AI in oncology landscape, backed by a confluence of factors including high disease burden, robust technology infrastructure, and a vibrant health innovation ecosystem. According to the National Cancer Institute, cancer-related healthcare expenditure in the U.S. is projected to exceed $245 billion by 2030, necessitating efficient and intelligent care delivery models. AI has become central to addressing this economic and clinical challenge.

Federal initiatives such as the Cancer Moonshot 2.0 and the NIH Bridge2AI Program are accelerating AI integration into cancer research and clinical care. These initiatives are funding AI-driven projects to improve early detection, patient stratification, and therapeutic targeting. Additionally, the FDA’s Digital Health Innovation Action Plan and its recent approvals of AI/ML-based Software as a Medical Device (SaMD) platforms have provided a regulatory roadmap for innovators. With strategic partnerships between tech companies, academic medical centers, and pharma firms, the U.S. continues to foster a thriving environment for AI in oncology.

U.S. AI In Oncology Market Recent Developments

-

March 2025: PathAI partnered with the Canadian Center for Regenerative Medicine (CCRM) to co-develop an AI platform for cell therapy manufacturing and quality control, aiming to accelerate personalized cancer treatments.

-

February 2025: Paige received FDA approval for its expanded AI pathology tool for detecting prostate and breast cancers, with enhanced deep learning modules that improve diagnostic accuracy in community hospitals.

-

January 2025: Tempus launched a new AI-driven clinical trial matching engine that analyzes patient genomic and clinical data in real-time to connect them to personalized cancer treatment studies.

-

December 2024: IBM Watson Health divested its oncology analytics platform to focus on specialty care solutions in partnership with major U.S. cancer centers.

U.S. AI In Oncology Market Top Key Companies:

The following are the leading companies in the U.S. AI in oncology market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. AI in oncology companies are analyzed to map the supply network.

- Azra AI

- iCAD, Inc.

- IBM

- Siemens Healthcare GmbH

- Intel Corporation

- GE HealthCare

- NVIDIA Corporation

- Digital Diagnostics Inc.

- ConcertAI

- Median Technologies

- PathAI

U.S. AI In Oncology Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. AI In Oncology market.

By Component Type

- Software Solutions

- Hardware

- Services

By Cancer Type

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Brain Tumor

- Others

By Application

- Diagnostics

- Radiation Therapy

- Research & Development

- Chemotherapy

- Immunotherapy

By End-use

- Hospitals

- Surgical Centers & Medical Institutes

- Others